Community Investment Tax Credit

The Community Investment Tax Credit is a unique program designed to inspire giving to nonprofit community development corporations like the CDP.

About the Program

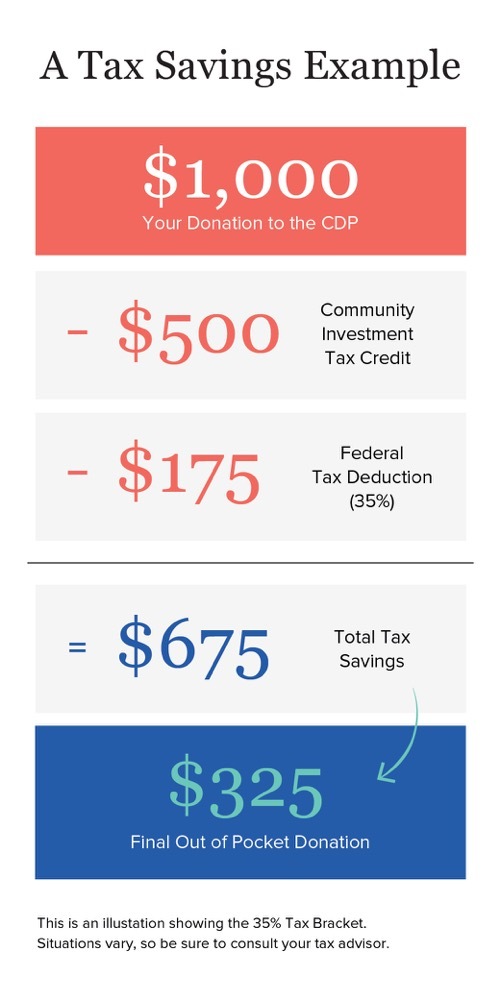

Here’s how it works. Let’s say you (or your business) contribute $1,000 to the CDP. We receive the full amount of your gift, yet the cost to you is just $500. That’s because you’ll get a $500 reduction in your tax bill from the state. And if you’re a donor with out of state tax liability (including family foundations and donor advised funds), you can still take advantage of the program because it is a “refundable credit”—the State of Massachusetts will send you a check for the credit.

Donor Benefit Highlights

- 50% Tax Credit on donations of $1,000 or more

- Excess state tax credit is refundable

- Donations remain eligible for federal charitable tax deduction

- Your gift is leveraged to produce more impact in our local community

Resources & Information

- Instructions CITC Returning Donor

- Instructions CITC New Donor

- Community Investment Plan

Contact Deb Martin

As a small—but growing—business, we know firsthand how important the CDP is for anyone getting started here. We’re grateful for their focus on young families and housing. Taking advantage of the Community Investment Tax Credit is smart. But truly, we give because we want to part of helping our community thrive. Kristen Roberts, Truro Vineyards and South Hollow Spirits

If you’re one of our steady supporters, this means you can double your gift to us, seriously strengthening our programs. Let’s say you—or your company—gave $1,000 last year. This year, if you double that gift to $2,000, the difference to our housing and business development work will be tremendous. Yet your net cost will be the same as last year because the state will give you a credit of $1,000.

If you’ve wanted to support the CDP, but haven’t made a gift yet, this is a great time to get involved.

This program means for every $1,000 you give, you’ll receive $500 back from the state at tax time. Consider a monthly gift---a minimum of $84 each month will make you eligible for this program.

Making a donation is easy. All eligible donations made in a calendar year will be included. Every year, we receive an allocation of up to 250,000 in Community Investment Tax Credits. Once we reach that goal the program will end for the year.

Contact Jamie Bearse, Chief Advancement Officer, if you’re interested in learning more about this program and ways to support the CDP's mission.

More Resources:

Commonwealth of MA Community Investment Tax Credit Webpage

MA Association of Community Development Corporations Community Investment Tax Credit Webpage

Federal Reserve Bank of Boston CITC Article